Make A Payment With A Debit Card

You can make a payment to your CME FCU loans or credit cards with a debit card from another institution. Pay via text message or on our website.

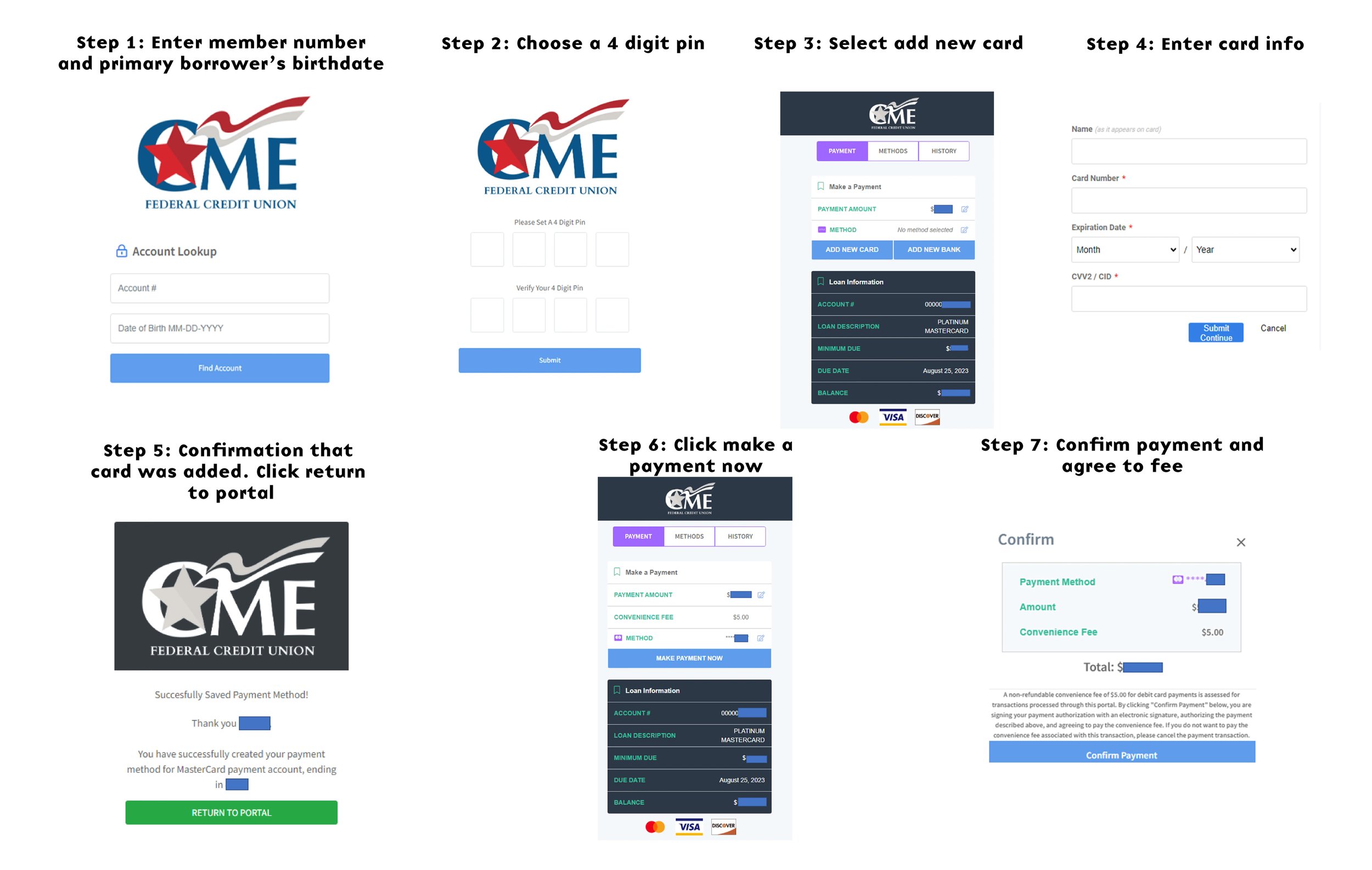

Steps to Make a Payment Using CME Federal Credit Union Portal

A step-by-step guide showing how to make a payment through the CME Federal Credit Union online portal.

Step 1: Enter your account number and the primary borrower's birthdate in the format MM-DD-YYYY. Click "Find Account."

Step 2: Choose a 4-digit PIN and verify it by re-entering it. Click "Submit."

Step 3: On the next screen, select "Add New Card" to proceed with adding your payment method.

Step 4: Enter your card information, including the name on the card, card number, expiration date (month and year), and CVV2/CID. Click "Submit Continue."

Step 5: A confirmation screen appears, indicating that the card has been successfully added. Click "Return to Portal" to continue.

Step 6: Back in the portal, click "Make Payment Now" under the "Payment" tab.

Step 7: Review your payment details, including the amount and convenience fee. Confirm the payment by clicking "Confirm Payment" and agree to the fee associated with the transaction.

IMPORTANT: Payments post immediately

WHAT YOU SHOULD KNOW

You will receive a text message informing you of the amount due on your loan. You will be able to review your payment options or you will be able to opt out of our text message service by texting “STOP”.

The link will take you to a portal where you will be asked to verify your account with your account number and date of birth.

When you verify your account for the first time you will have to setup the following:

4 digit pin: once you have entered your account number and date of birth, it will prompt you to create a 4 digit pin. Store this information in a secure place as you will need this pin number to verify future payments.

Preferred method of payment: to make a payment you will have to add your preferred form of payment in the portal. You can do this by selecting ADD NEW DEBIT CARD which will prompt a secure website for you to input your information. If done correctly, there will be a message stating ‘Payment Method Success’ and you will be redirected to the payment portal.

Once your account has been successfully verified, you will be directed to the payment portal where you’ll be able to see all of your loans and will also be able to select your preferred payment method.

MEMBER BENEFITS

The transaction fee is only $5.00

Encrypted information guarantees your information is secure

Convenient ways to pay from an external account: text or on our website

Payments accepted from checking accounts and debit cards